This problem came about mostly because the first release of the 2012 tax tables put employee FICA back to 6.2%. As you all know, recent legislation kept the employee rate at 4.2%.

Well, for you early adopters out there, you may have a problem.

This blog article includes a proposed series of steps you can take to resolve the issue of having over withheld FICA the extra 2% that was part of the first release of Release 1 of the 2012 tax tables.

You have two problems when you Over withhold FICA (or any tax).

First problem: You need to give the employee back the money and correct his payroll summary to reflect the correct FICA. This fix assumes the percentage was wrong; it does not include the added complication of FICA wages being wrong. Meaning that you included an amount in FICA wages that you shouldn’t haveSecond problem: Fixing the employee’s tax record in GP so it properly reflects the amount of FICA tax withheld.

Problem 1: Fixing the Employee

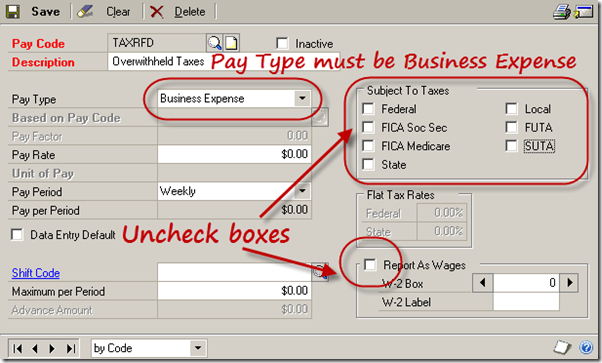

1) Set up a new pay code (or use an existing) with the pay type of ‘Business Expense’. Uncheck all of the ‘Subject to Taxes’ boxes and make sure the ‘Report as Wages’ box is not checked

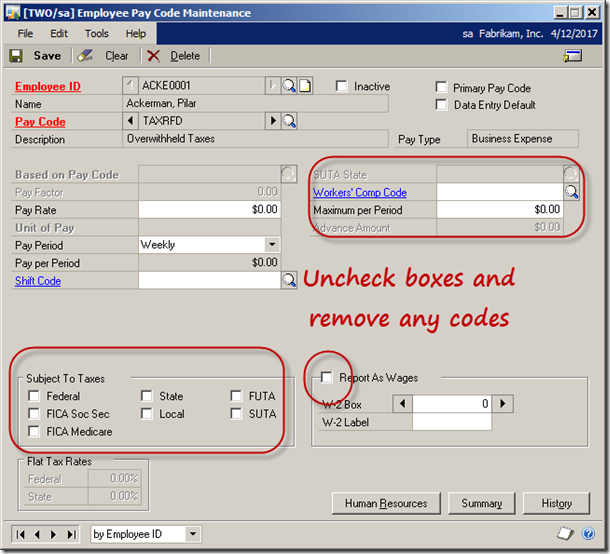

2) Assign this Pay Code to the employee needing the refund, accept the company defaults. Be sure the Workers’ Comp Code is blank.

3) Enter a payroll transaction for the employee needing a refund and use the Business Expense pay code you set up in step (1). Make sure no taxes are calculating.

4) Close the batch and build the check(s). Make sure:

a) No automatic pay types are checked

b) You have included the pay period that you put on the employee pay code

c) No deductions are included (check it, don’t presume)

d) No benefits are included (check this too)

e) Don’t forget to select the batch you just created

5) Select ‘Build’ when you are happy with the settings.

6) Check your Build report for errors – you shouldn’t have any.

7) Calculate checks from payroll transactions menu

8) Print the checks and post the batch.

9) Make sure NO other entries are on the report except for the amount paid the employee. There should be NO TAX, NO BENEFITS, NO DEDUCTIONS.

The employee should be fixed at this point as far as getting their money back, now to deal with the FICA tax record.

Problem 2: Fixing the Employee FICA withheld amount.

1) You will use the Payroll Manual Check window to adjust the tax.

2) DO NOT enter a batch ID for this transaction.

3) Select the Transaction Type as FICA Soc Sec Tax, the Code FICASS should appear on the window.

4) Enter the amount that you refunded the employee AS A NEGATIVE NUMBER in the amount box.

5) We aren’t doing anything to Taxable Wages, so leave that field blank.

6) Save the transaction and make sure the Net Amount is the amount that was over withheld.

7) Post the entry – remember no batches!

8) Watch your Distribution accounts and checkbook register because those may have to be adjusted, depending on your settings

Good luck with it.

There are probably other ways to do this and I invite your comments. This is the way we have been doing it.

Kind regards,

Leslie

No comments:

Post a Comment